Aella Credit’s AI-Powered Financial Services: What You Need to Know

Aella Credit

Financial services play a critical role in empowering the underbanked populations worldwide by providing them with easier access to credit. Aella Credit, now known as Aella Microfinance Bank, is a fintech startup that has revolutionized the financial services landscape for the underbanked in Africa. Headquartered in Lagos, Nigeria, with offices in San Francisco and Manila, Aella Bank provides instant loans through a mobile application platform, leveraging cutting-edge AI technologies to improve identity verification and enhance service delivery.

Aella Bank has taken on this mission through its mobile loan application platform. They leverage Artificial Intelligence (AI) to drive business growth and improve their service offerings significantly.

Aella Credit Company Overview

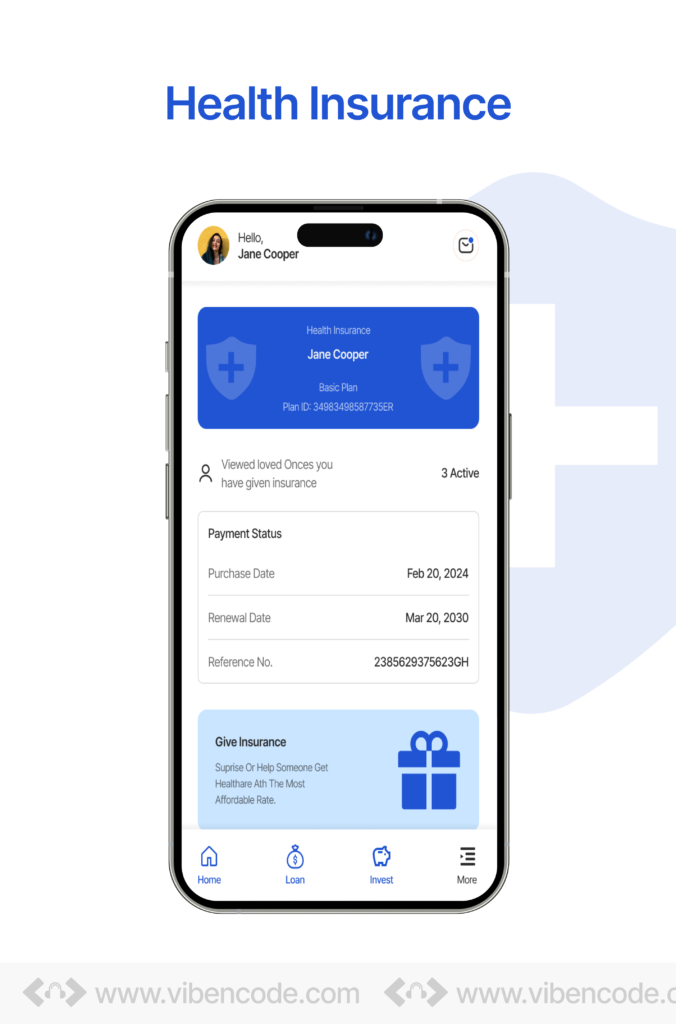

Aella Microfinance Bank offers diverse financial products, including

- low-interest loans

- high-interest savings plans

- Zero-maintenance fee debit cards

The company's mission is to make financial services accessible to all Nigerians, particularly the underbanked, and to drive financial inclusion across the continent. With over 2 million users, the Aella loan app has positioned itself as a leader in the Nigerian fintech sector.

Problem Statement

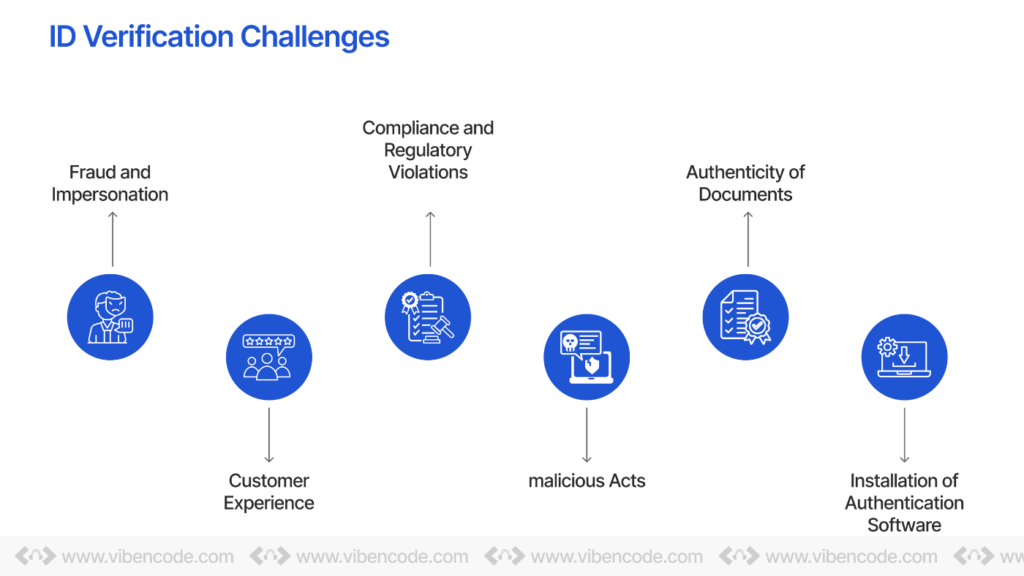

Initially, the Aella loan app faced significant challenges with identity verification due to the lack of a reliable API for real-time verification of government-issued IDs in Nigeria. This issue resulted in multiple overlapping user profiles and duplicate datasets, complicating the loan approval process and hampering growth.

Traditional Methods Vs. AI-driven Solutions

Traditionally, financial institutions rely on manual processes for identity verification, which can be both time-consuming and prone to human error. In Nigeria, this method also incurs additional challenges given the lack of a standardized verification system. The need for a better solution was evident.

Enter AI-driven technologies, which promise to overhaul traditional practices, reduce errors, and significantly improve efficiencies. By employing AI for identity verification, companies like Aella Bank can overcome traditional limitations and scale their operations more effectively.

Solution: AI-Powered Identity Verification

Recognizing the limitations of their existing technology infrastructure, Aella Bank decided to migrate to a more robust and scalable cloud solution. This led them to Amazon Web Services (AWS). While AWS products provided a seamless migration experience, a crucial component of their transformation was the integration of Amazon Rekognition deep learning-based image and video analysis service.

Implementation

- Facial Detection for New Customers: Customers upload their profile images to the mobile app, which are then analyzed. The results are stored in Simple Storage Service (S3) and further processed for verification.

- Profile Updates: When customers update their profile images, Rekognition (cloud-based software) compares the new images with existing ones. If a match is found, the update proceeds; otherwise, the process is repeated.

- Government ID Verification: For customers applying for larger loans and employees of partner companies, Rekognition compares uploaded government-issued IDs against a base sample to ensure authenticity.

The migration to AWS and the adoption of Rekognition enabled Aella Bank to cut down identity verification errors and speed up the process, laying a strong foundation for their rapid growth.

Challenges Overcome

By integrating AI technologies, Aella Bank overcame several significant challenges:

- Real-time Verification: Eliminated delays associated with manual verifications.

- Accuracy: Improved the accuracy of face verification by over 40%.

- Scalability: Seamlessly scaled up to accommodate a growing customer base.

Results Achieved

The adoption of AI-driven identity verification has given the Aella loan app a competitive edge. Here are some key achievements:

- Zero Downtime: Ensured high availability of loan processing software and customer databases.

- Customer Growth: Expanded from 5,000 to 200,000 customers in a matter of months.

- Operational Efficiency: Relieved from the burden of manually managing infrastructure, allowing focus on innovation.

Aella Credit’s experience demonstrates how AI and cloud technologies can drive significant business value, particularly in industries with complex verification requirements.

The Financial Services Industry and AI

The financial services industry faces numerous challenges, including fraud prevention, customer verification, and risk assessment. AI technologies, such as facial recognition and advanced data analytics, can address these challenges effectively:

- Fraud Detection: Real-time analysis and pattern recognition help in identifying and preventing fraudulent activities.

- Efficiency: Automated processes reduce the time and cost associated with manual verifications.

- Customer Experience: Enhanced user experience with faster and more reliable verification methods.

Vibencode’s Expertise in AI Solutions

At Vibencode, we specialize in leveraging AI and generative AI technologies to solve complex challenges across various industries, including financial services. Our deep expertise aligns seamlessly with the solutions deployed by Aella Credit. From identity verification to customer engagement, our AI-driven approaches are designed to deliver superior value.

Contact us to discover how Vibencode can help your organization leverage the power of AI for transformative business growth.

Stay tuned for more insights in our ‘AI in Action’ series, as we continue to highlight innovative AI applications across different sectors.